Future School Funding

Where will it come from and will it go in Illinois?

By Matt Seaton

Chief Financial Officer

Illinois State Board of Education (ISBE)

To say that the current school funding landscape is complicated is an understatement. So much has changed in the last fiscal year that many school leaders are left wondering about the certainty of school funding during upcoming fiscal years. Illinois school districts have seen funding mechanisms change dramatically over the past 15 years. Some of these changes have been in the once-in-a-generation category, such as the passing of the Evidence-Based Funding (EBF) formula in 2017. Yet, prior to 2017, Illinois school districts faced financial challenges that also could have been considered once-in-a-generation circumstances that resulted from a significant economic downturn beginning around 2008. How will the future compare to that time in Illinois school funding history?

Economic assumptions that were used for the financial future in Illinois have changed multiple times in the past six months. In the most recent update to the revenue forecasts for Illinois, the Commission on Government Forecasting and Accountability shows revenue growth for the state of Illinois slowing considerably. Revenues overall for the state grew at a pace of 8.1 percent and 4 percent in Fiscal Year 2022 and Fiscal Year 2023, respectively. However, the rates of growth are projected to be at -1 percent, 1.9 percent and 1.1 percent for Fiscal Years 2024, 2025 and 2026, respectively.1

In times where state revenues appear to be slowing, it is important that school districts begin analyzing current trend data that directly affects funding, such as equalized assessed valuations (EAVs), enrollment data and community economic conditions, to create a three-year forecast now to assess any potential financial impacts.

Where Does the Money Come From?

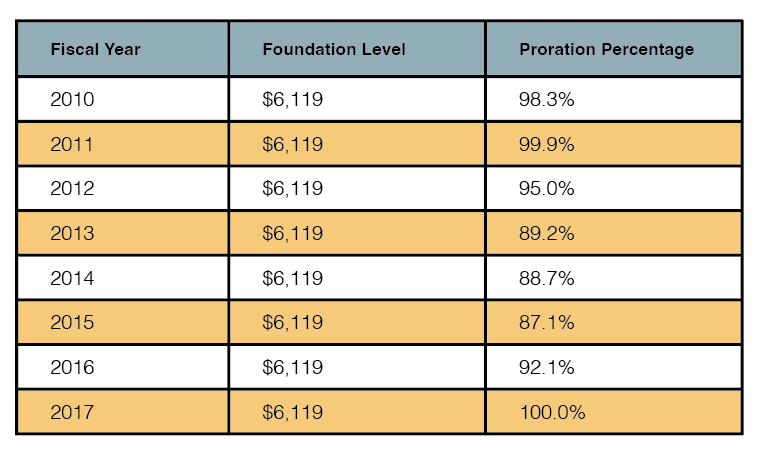

Prior to the implementation of the EBF formula, the state of Illinois utilized a General State Aid (GSA) formula. The Foundation Level per student for GSA rose from $4,964 to $6,119 from 2005 to 2010. The Foundation Level then remained at $6,119 until EBF was implemented in Fiscal Year 2018. However, beginning in 2010, the General Assembly did not appropriate enough funding to cover the entire dollar amount needed to fund the Foundation Level at 100 percent, thus resulting in proration. The following table illustrates the year-over-year proration percentages for GSA.

During these times of proration, school districts that relied more on state funding than local wealth saw their overall revenues decline disproportionately as compared to the districts that had more wealth from local resources. This resulted in GSA becoming a regressive funding mechanism for schools, with districts most reliant on the funding seeing a larger share of the cuts to their budgets year over year. To put it more in perspective, a district with a $10 million budget that relied on GSA for 60 percent of its overall budget would have realized a greater reduction in overall revenues while a district with a similar budget that relied on GSA for 20 percent of its budget would have realized a smaller decrease in overall revenues. The More a District relied on the state GSA formula for funding, the more that district lost in actual funding under proration.

Beginning in Fiscal Year 2018, the state began investing $350 million annually into the new EBF formula, which dramatically increased the amount of additional state funds made available to the schools most in need. The Illinois State Board of Education (ISBE) has historically seen budget increases for projects paid from state resources ranging from $2.89 million in Fiscal Year 2021 to a historic high of $726.52 million in Fiscal Year 2018, largely because of the implementation of EBF. In recent years, state funding increases have ranged from $429.87 million in Fiscal Year 2022 to $607.83 million in Fiscal Year 2024. The state budget for ISBE for Fiscal Year 2026 is increasing by $278.83 million from Fiscal Year 2025, which is a 54 percent decrease in new state resources over the last two years.

Looking further out, the Governor’s Office of Management and Budget (GOMB) issues its annual five-year fiscal forecast each November. In the most recent iteration of the forecast, GOMB projects that K-12 funding in Illinois will only increase by approximately $350 million annually between Fiscal Years 2028 and 2030.2 The statutory EBF increase is set at $350 million, which means GOMB is projecting increases that will not be able to fully fund combinations of increases to EBF, increases to Mandated Categoricals (MCATs) or any other line items.

MCATs consist of payments made for specific services provided to students, including transportation for regular and vocational students, transportation for special education students, tuition for students who attend special education day programming, tuition for regular education and special education students who are housed in orphanages, as well as for free and reduced-price food programs for students. These line items in the state budget have historically been underfunded, with regular and vocational transportation reimbursement only providing for about 79 percent of the funds needed by districts to operate and special education transportation reimbursement coming in at only 69 percent. School districts that are above 100 percent of adequacy according to the EBF formula do not receive significant increases in state funding through EBF, making MCATs a significant source for increases in state funding. In fact, districts in Tier 3 in Fiscal Year 2025 received a total average increase in EBF of $2,909 while districts in Tier 4 only received a total average increase of $323. Meaning, if MCAT funding is flat or reduced, these school districts likely are receiving little, if any, increases in state funding.

Other than an increase of $19.9 million to the two lines funding regular and special education orphanage tuition payments, there is no increase to the remaining MCAT lines in the Fiscal Year 2026 enacted budget, so the prorations for the two transportation line items are projected to drop to approximately 73 percent for regular and vocational and 61 percent for special education. Regular and special education orphanage tuition will be paid at 100 percent in Fiscal Year 2026. ISBE will not know the final percentages until the claims from school districts are finalized annually around the time of this article’s publication.

On the federal front, the Trump administration issued more details on June 3, 2025, regarding the budget proposal for federal Fiscal Year 2026. The budget calls for a 14 percent reduction in federal funding for the U.S. Department of Education, while zeroing out many grant programs and “combining” the funding into a simplified funding program with an appropriation of $2 billion. Grants proposed for zeroing out include Comprehensive Literacy Development Grants, English Language Acquisition, Supporting Effective Instruction (Title 2 Part A), Title 3, Title 4 Part A, 21st Century Community Learning Grants and Adult Basic and Literacy Education State Grant Programs, among others.3

The federal budget must pass through the normal congressional process for passage; it’s important to note that the president’s proposed budget may or may not be used as the foundation for the congressional budget development process. The federal budgeting process could take months to complete, giving local school leaders no guidelines on which to budget.

Diminishing state and federal resources could create hardships for school districts that are more reliant on these funding streams as compared to school districts that rely more heavily on local resources.

Where Will the Money Go?

The average Per Capita Tuition Charge (PCTC) for Illinois school districts has risen from $11,740 in Fiscal Year 2018 to $16,585 in Fiscal Year 2024, a 41.3 percent increase. PCTC does not factor in federal funding, so the additional revenues received during the COVID-19 pandemic are not included in these increases. At the same time, state funding for public education in Illinois has increased from $8.22 billion in Fiscal Year 2018 to $11.17 billion in Fiscal Year 2026, a 35.9 percent increase. Similarly, the amount of aggregate EAV available to all school districts in Illinois has increased from $494,323,083,118 in tax year 2018 to $628,379,123,277 in tax year 2024, a 27.12 percent increase. Note: The EAV numbers presented are for all districts, including overlapping high school and elementary districts, in order to estimate available EAV to school districts.

The average PCTC calculations are outpacing the increases in both local and state revenues. As revenue begins to slow, districts should now be considering ways to manage ever-increasing costs with slower-increasing overall revenues.

With the possibility of cuts at the federal level in some grant programs, districts may need to consider alternative resources that are available to maintain the levels of services to meet the needs of students served by some federal programs.

Districts should work locally to estimate increases in local revenues, such as property tax revenue and personal property replacement tax, over the next three years. Mainly because school districts in Illinois vary greatly in the amounts of local, state and federal resources they have available for educational services and operations. The school districts that receive considerable funding from the state — whether it be in EBF funding or MCAT funding or other sources — can access ISBE staff to support in estimating projections for state resources.

Federal funding will remain difficult to project as Congress continues to move through the budgeting process. School districts may be able to access carryover funding to assist in the short term with any potential reductions in future federal funding.

The use of a three-year rolling financial projection is a tool that can be used for district financial planning and will assist districts in communicating the current financial state of a district and the plans for the district to remain fiscally viable. ISBE offers workbooks for free that can be used to develop these plans, and there are a number of consultants in the K-12 space who can assist districts with financial planning.

ISBE offers free services available to all school districts with support in developing financial planning models through the Regional Financial Consultant program. These services can be accessed by contacting the ISBE School Business Services Department at finance1@isbe.net.

Resources:

1. FY 2026 Economic Forecast and Revenue Estimate and FY 2025 Revenue Update

2. hGOMB Illinois Economic and Fiscal Policy Report

3. https://www.edweek.org/policy-politics/trumps-education-budget-calls-for-billions-in-cuts-major-policy-changes/2025/05?M=13711807&UUID=99d248fdfda7c2e09b267bf371c8d1c6&T=17924979